Buy & Hold investing can leave you feeling powerless. Add some TAA to your portfolio and take back control.

Tactical Asset Allocation (TAA) adds strong diversification alongside a Buy & Hold investment strategy. I compare the two strategies and highlight their differences.

In my 20s, I consulted for Accenture out of its Milwaukee office. One highlight of working at a big firm in the late 90s was the sometimes extravagant employee perks.

The greatest perk took place one day in October every year. To reward us for a job well-done, Accenture leadership would rent out Six Flags Great America… in its entirety. I would always bring my girlfriend (now wife).

Imagine showing up at Six Flags just north of Chicago, parking in the front row, and walking into an empty park. It wasn’t as empty as Wally World when the Griswolds visited. But close…

Our small group would ride Iron Wolf and American Eagle and our favorite, Raging Bull. At times you needn’t get off to get back on! One year, I think I went on 50 rides in a day.

My wife and I bonded over our shared love for roller coasters and these incredible days at Great America.

In 2018, twenty years later, she and I were living in the Bay Area. That year, we hired a sitter and drove 30 minutes to Six Flags Discovery Kingdom in Vallejo. We got there early. With excitement, we boarded our first ride.

When we got off, we looked at each other and said, almost in unison, “I don’t think I can do another one.” We pushed through it, tried one more, and both nearly lost our breakfast. Dizzying.

The roller coasting chapter of our lives had closed.

My investing roller coaster

I felt the same way when watching my 80/20 investment portfolio crash in March 2020. What hadn’t bothered me in 2001 and 2008 now did. I could no longer stomach the steep losses. Why?

I looked at my now greater savings as the collection of 20+ years of hard work. Watching $300K vanish was hard to take. I remember thinking, “I’ve just lost 6 years of savings…6 years of sacrifice.”

At least I didn’t pass out like I almost did at Six Flags.

Now, let me fast forward through 18 months when I read everything about investing that I could get my hands on.

I had found an investing strategy to complement my Buy & Hold portfolio.

It’s a great diversifier, without dilution. Meaning, it enhances my investment returns. And, best of all, it reduces my risk of severe loss and helps me sleep better at night.

Tactical Asset Allocation (TAA). It’s the investing strategy I teach at FastFollowInvestor.com.

Comparing two strategies

To learn TAA, I checked much of what I already knew about investing at the door. Like Adam Grant recommends in Think Again, I had to 1) unlearn and 2) relearn.

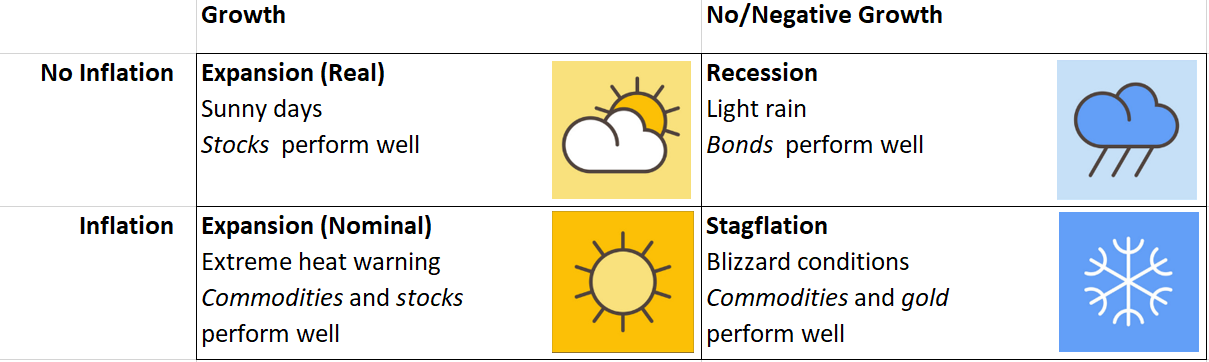

Take a look at these comparisons I’ve drawn:

There is a lot here, I know. It took me almost a year to understand TAA. It’s new and different. And it doesn’t always align with popular beliefs.

So, this is my challenge: How can I best share this strategy so everyone benefits?

Expanding the analogy

Derek Thompson, one of my favorite podcasters, speaks in analogies.

It can help new ideas stick. So let me try one.

I think of Buy & Hold investing like that ride on a roller coaster.

A roller coaster entertains riders with steep climbs and steeper drops.

You must put your trust in the ride because you have no control.

For long stretches, there is a lot of up and down, but you make no vertical progress.

But, riding is easy. You get on the ride and go (think: set it and forget it).

Tactical Asset Allocation (TAA) is more like a mountain trek.

Hiking a mountain takes preparation and, sometimes, training.

You choose your path, and so control your destiny.

While you may need to backtrack, it’s minimal if you plan your route well.

When you reach the summit, you’re exhausted but feel great given the achievement.

Use both for strong diversification

Buy & Hold and TAA are valid investing strategies.

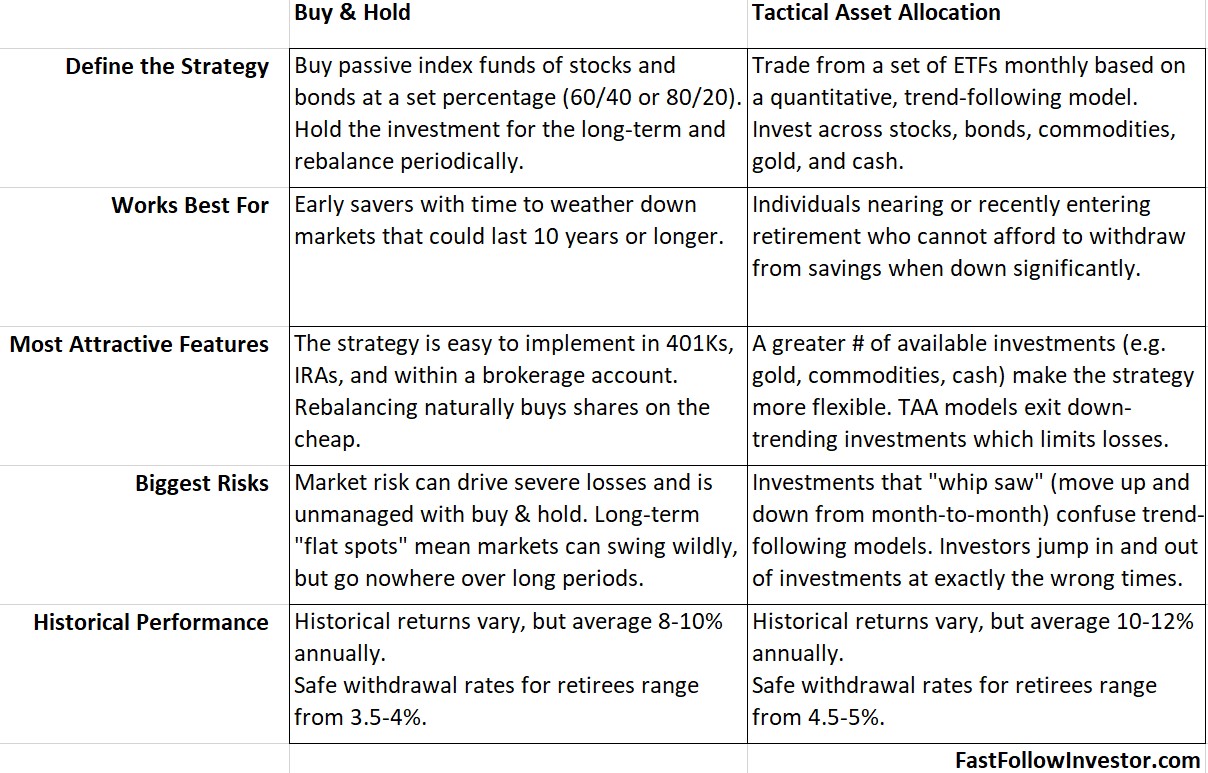

You can expect positive returns from both. But, one may work better than the other in certain situations.

One obvious use case: the new saver has time to reap rewards from Buy & Hold. The soon-to-be retiree does not have the time and should tilt her/his portfolio toward TAA.

Buy & Hold and TAA are excellent diversifying strategies.

Together, they reduce your portfolio’s overall volatility and don’t dilute investment returns. Diversification, not diworsification.

And how fortunate this is! Take a small piece of your Buy & Hold portfolio and try it out. Dipping your toe in the TAA waters is a good way to learn something new and manage risk at the same time.

When you’re ready for more, you can watch my trades monthly in real-time at FastFollowInvestor.com.

Tweet

Subscribe to get my posts sent to your Inbox. Thanks!