Holding cash can be a strategic investment move! Cash helps you take advantage of market downturns. With cash, you can shop for value when others are selling at a loss. Look no further than Warren Buffett for how to take advantage of this strategy.

Imagine your cash savings like a red fox standing watch over a gopher hole. It stays there quiet…for an excruciatingly long time. Then, at a moment’s notice, when the gopher’s head surfaces…it pounces!

In this post, you will learn how holding cash in your investment portfolio creates wealth. Cash savings is a key part of the Idols Framework for wealth building. Cash provides a “margin of safety” which keeps you in the investing game. Experts teach you to have a strong defense and build an emergency fund.

But cash - which to most appears boring, tired, and too low-yielding - is also a stealthy and opportunistic investment.

Main topics covered

- History provides illustrative examples of great wealth built with cash savings. This approach is time-tested.

- Holding cash is not just for emergencies. Yes, cash provides protection against loss. It also offers purchasing power when great investments “go on sale”.

- I analyze several options. Then, I share my favorite places to store cash and thoughts on how much to hold in your portfolio.

Detailed table of contents

1.0 Why keep cash savings?

1.1 My 1997 cash savings example

1.2 Warren Buffett is the master

1.3 More historical examples

1.4 Deals come along often

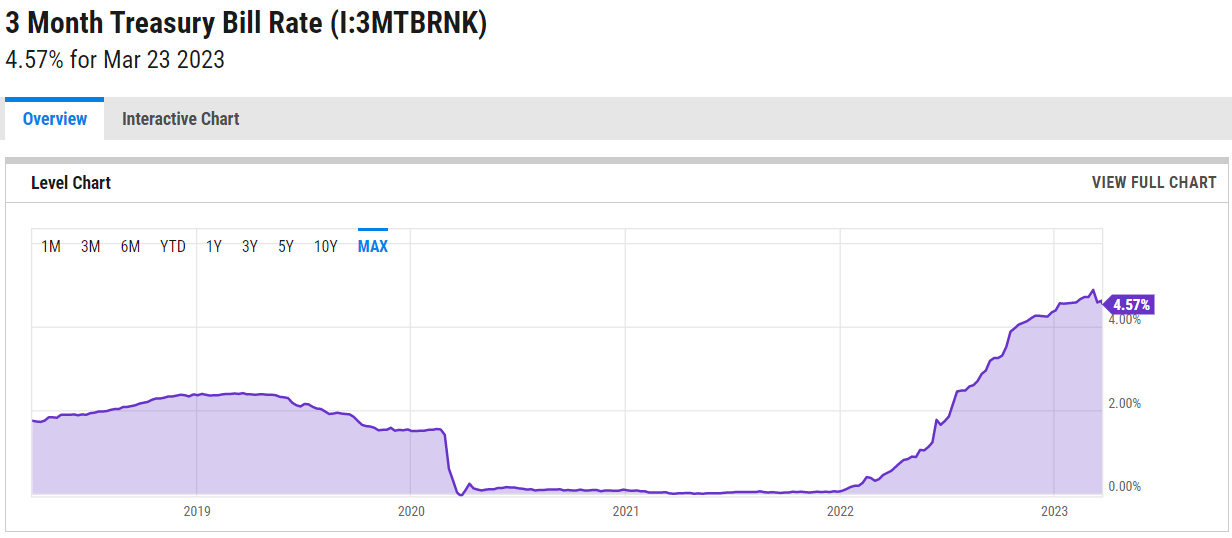

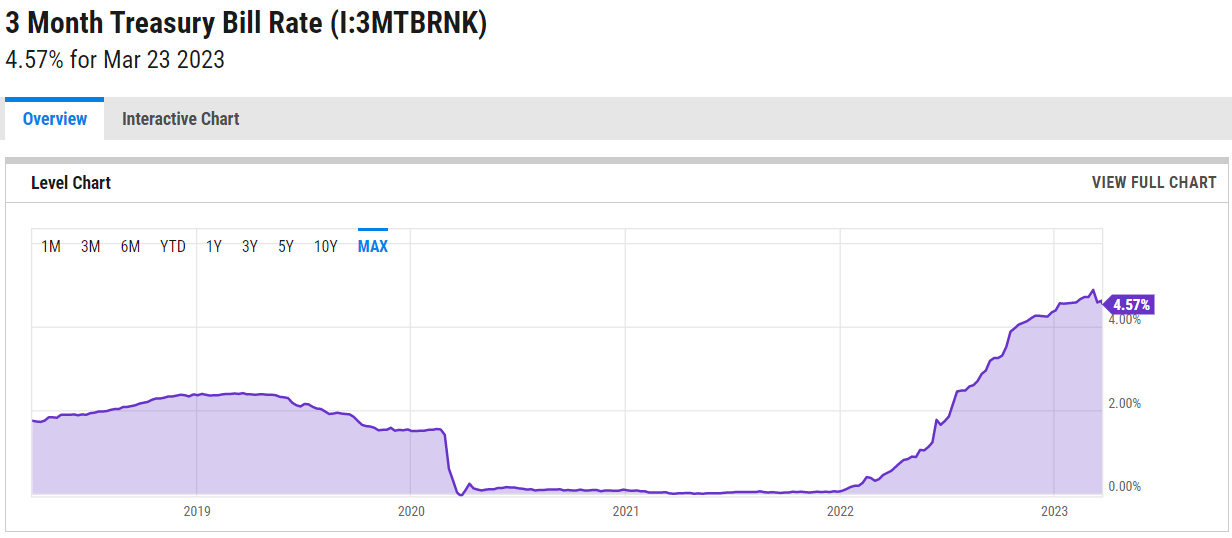

2.0 Earning the best possible return

2.1 Defining the term “best”

2.2 High-yield savings accounts >$250,000

2.3 Short-term treasuries (T-bills)

2.3.1 TreasuryDirect.gov

2.3.2 Treasuries via your brokerage

2.3.3 Ultra-short-term bond funds

2.4 Money markets backed by the U.S. government

2.4.1 Sweep accounts

2.4.2 Purchased money funds

2.5 Summary table with recommendations

2.6 Point-in-time analysis: April 2023

3.0 How much cash to hold?

3.1 Emergency fund and more

3.2 Opportunistic mountain of cash

3.3 Real-world considerations

4.0 Cash savings summary

5.0 Related posts

Why keep cash savings?

Charlie Munger, Warren Buffett’s wise partner at Berkshire Hathaway, said “It is not brains but temperament that makes you rich. Have patience! And don’t do anything stupid.”

Holding cash in your portfolio is the ultimate exercise in patience and levelheaded temperament. It is hard to sit on a mountain of cash when stock (or crypto) investments go up and up in the final years of an expansion. “Blow-off tops” can run for years!

Why quietly stare at that gopher hole for so long?

My 1997 cash savings example

Let’s explore a scenario at a point in time: 1997, the year I graduated and started working. Imagine we are 7 years after the most recent market correction (October 1990).

Seven years post-crash, the economy and markets have likely recovered. It is when growth starts getting a little crazy and too much money floods the markets. (It would for another 3 years through 1999.)

In this example, let’s invest $100,000. (This part does not reflect my personal reality in 1997 upon graduating!) A single $100,000 investment keeps the math simpler. Later, I’ll show that markets turn south every ~10 years. So, at this point, our investment will grow for 3 years.

Consider these two cases:

Case 1: What I did in 1997

- Put the money into a stock index fund and keep $100,000 invested for 3 years at 8%.

- It grows to $126,000 over 3 years (1999).

- When the market drops 40% (end of 2002), the investment is worth $75,000.

Case 2: What I could have done in 1997

- Sit tight and put $100,000 in a cash savings account, invested for 3 years at 3%.

- It grows to $109,000 over 3 years (1999).

- As the stock market drops, stay put and savings grow to $120,000 (2002).

In Case 2, I’m up $45,000 over Case 1. In 2003, I move my cash into a stock index fund that is on sale.

In this example, I’m looking backward. You could argue that I’m cherry-picking data to prove my point. That is true. But the key point is this: “Markets turn south every ~10 years”.

In 2023, a correction could come soon. The stock market has expanded for 15 years! As bubbles form, smart investors set aside more of their portfolio in cash. Cash gives you options, and options are valuable. With cash, you are able to move fast when you find an edge.

How much cash to stash varies with your specific situation and other investment opportunities. (More on that later.) But, the lesson here is that you should hold some!

Warren Buffett is the master

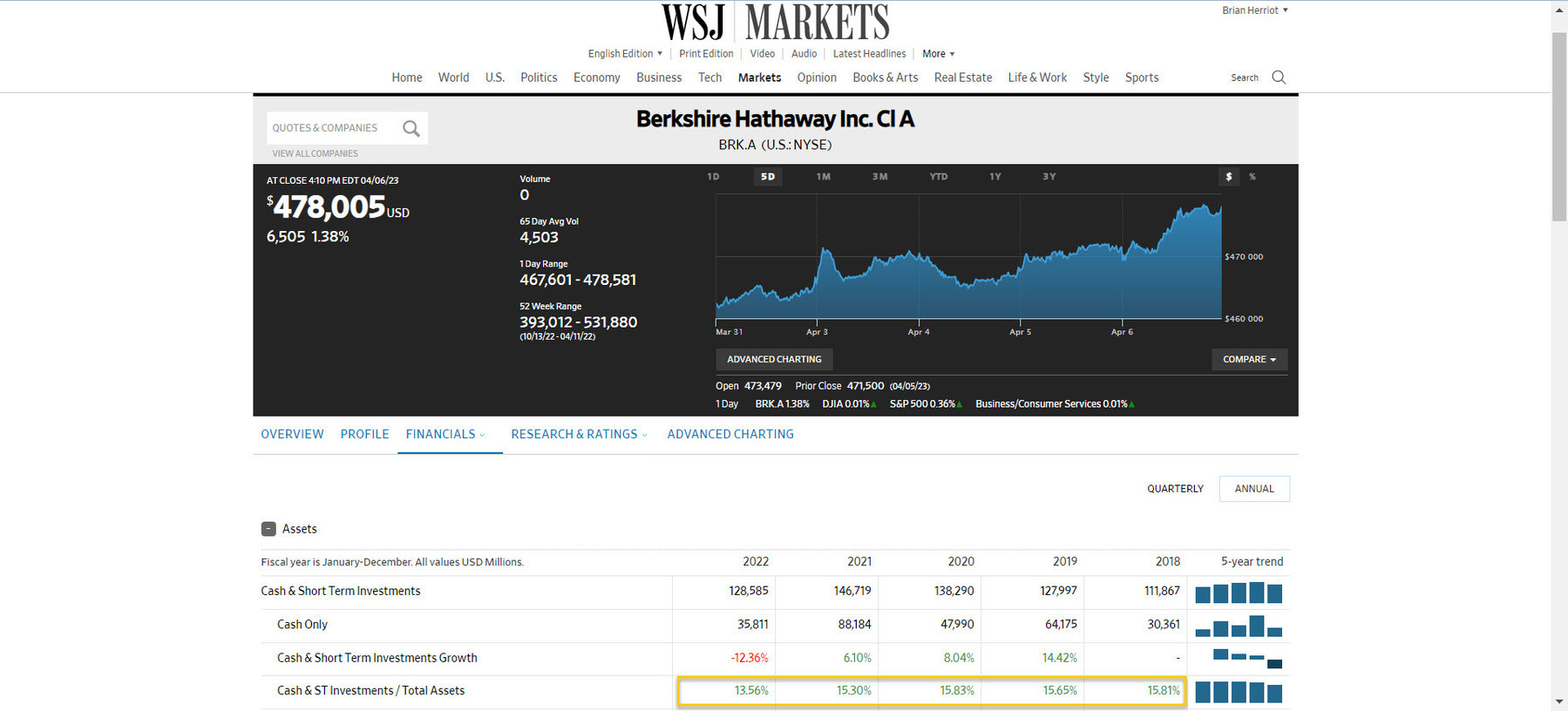

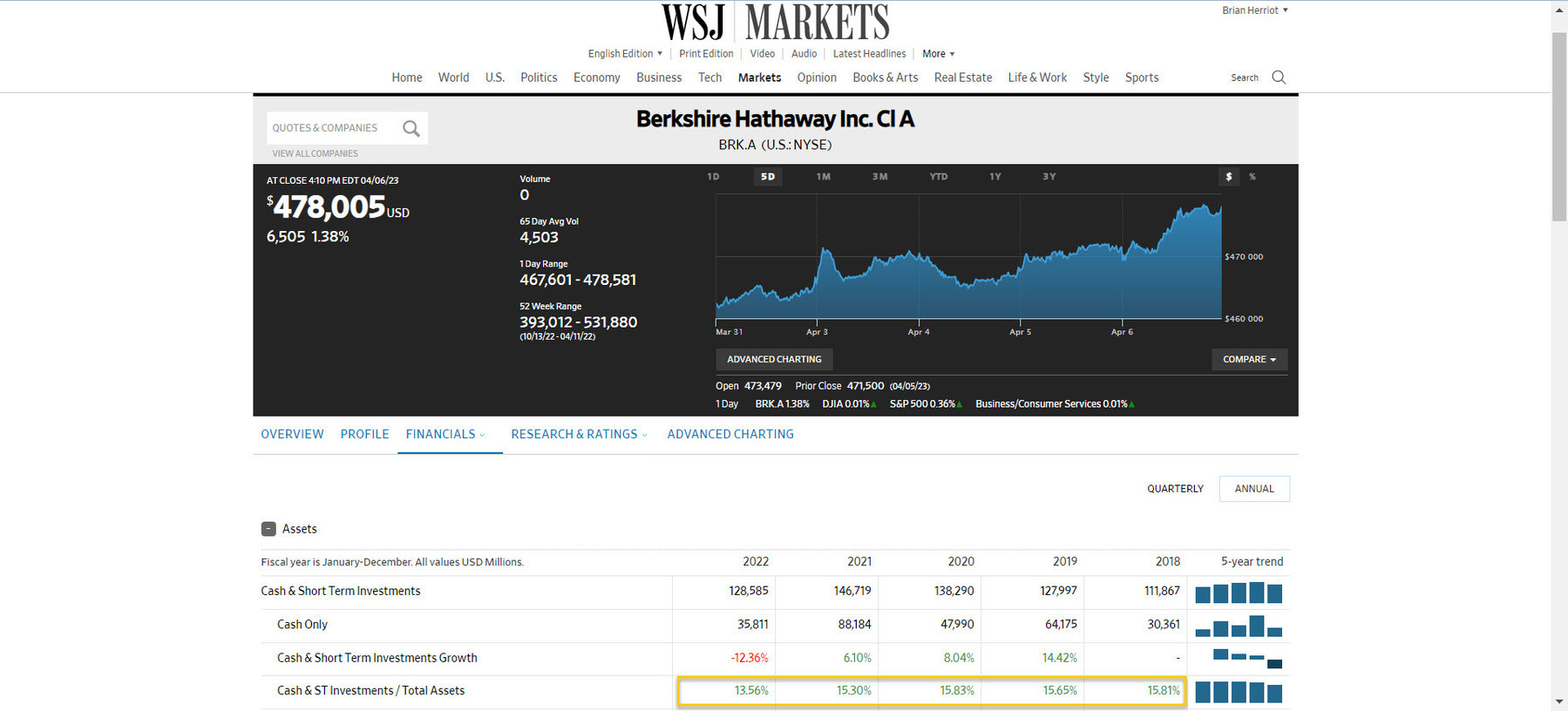

Berkshire Hathaway keeps 10-20% of its investment portfolio in cash. The money is ready when great companies become available to buy at great prices.

Charlie Munger reminds us:

- “It’s in the nature of stocks that they go down from time to time.”

- “Cyclical financial crises are in the nature of capitalism.”

- “Random recessions and crashes are programmed in.”

In other words, markets will crash. You’d be irresponsible not to prepare for it.

Berkeley Hathaway flips a market crash on its head. It’s not horrific, but delightful:

In 1988, Warren noticed a unique opportunity in Coca-Cola’s tragic New Coke experiment. He began to accumulate shares of the beaten-down stock. As of this writing, COKE’s stock price is $61. His $1.3 billion stake has grown to $24.2 billion in 27 years. That’s an almost 19-fold gain.

Here’s another example. Warren swooped in during the 2008 financial crisis. He invested $5 billion in Goldman Sachs. In 2011, Goldman Sachs redeemed the shares, earning Berkshire Hathaway a profit of $3.7 billion.

There are many examples from history

While Berkshire has perfected this approach, it is not new. The smartest investors learn from history. Here are three more:

- Hetty Green was a shrewd and frugal American businesswoman and investor in the late 19th and early 20th centuries. She amassed great wealth by investing in railroads, real estate, and government bonds. After market crashes, Hetty preyed on low prices, and she became the richest woman in America.

- Alfred Lee Loomis was a successful American attorney, investment banker, and scientist who gained prominence during the early-to-mid-20th century. Alfred made several strategic investments in the aftermath of the 1929 stock market crash. His opportunistic investing helped him grow his wealth during difficult economic times.

- Issy Sharp is the 91-year-old founder of the Four Seasons Hotels. Issy developed his edge in the hospitality industry. He used market crashes to invest in luxury hotels and pick up great properties at great prices. Issy capitalized on these opportunities to expand the Four Seasons brand worldwide.

Deals come along more often than you think

Recent history reminds us how often deals come along. We experienced major market drops in 1973, 1987, 2000, 2008, and 2020. That is 5 times in the last 50 years or roughly once every 10 years. Ten years is a long time. This is a true lesson in patience!

- 2020: The Covid Crash, S&P 500 loss: 34%

- 2008: The Subprime Mortgage Crisis, S&P 500 loss: 57%

- 2000: The Dotcom Bubble, Nasdaq loss: 77%

- 1987: The Black Monday Crash, Market loss: 34%

- 1973: The Oil Crisis and Economic Recession, Market loss: 48%

Before 1973, crashes were even more frequent. These earlier crashes (known then as “financial panics”) include the 1929 Crash (and the ensuing Great Depression). The worst crash in history resulted in the Dow Jones index losing 89%.

I’m not going out on a limb to say that we can expect a crash of 30-50% or more, and likely soon.

How to earn the best possible return while you wait

There are several places where you can stash your cash. The recent run on Silicon Valley Bank reminds us that every option must be safe and as riskless as possible.

The options I examine will be either:

- Direct investments in short-term U.S. government securities

- Short-term investments backed by the full faith and credit of the U.S. government

I’m not messing around here. These cash investments are safe.

Thus, I’ll examine:

- High yield savings accounts >$250,000 FDIC-insured limit

- Very short-term U.S. treasuries: Treasury bills

- Money market funds holding assets backed by the U.S. government

Definition of “best” return

These 4 criteria combined make up my definition of “best”.

- Safe and riskless - All cash investments meet this criterion with the U.S. government’s backing. The securities have short durations, which means that sudden interest increases do not destroy their value.

- Cheap - As with all investments, fees reduce the investment return that you earn. The lowest fee option is the best.

- Highest yielding - When equally safe and riskless, the highest-yielding investment is preferred. Earning interest is not the primary purpose of holding cash, but why not earn the best possible yield?

- Easy to manage - How difficult is it to keep this money safe? This may not seem important if you’re thinking only of keeping a savings account. It will be when we discuss how to buy Treasury bills direct from the U.S. government. It’s not easy!

My analysis searches for the optimal combination of 1) net yield (return after fees) and 2) ease of holding and transacting. The U.S. government backs all options and guarantees their safety.

I will assess various cash savings options first without considering point-in-time investment yields and costs. Then, I will include these details as of April 2023. I share current net yields with Fast Follow Investor community members.

Let’s get started.

High-yield savings accounts >$250,000

Let’s start with the passbook savings account you got as a kid from your hometown bank. Now, we’ll make some improvements to it:

- You’re older now and have more money. Always open enough accounts so each holds less than the FDIC-insured maximum of $250,000. Most of us have less than $500,000 of savings, so keeping it in two accounts isn’t too much hassle.

- Instead of the local bank, use an online bank which has lower operating costs. Online banks pass these savings to you in the form of higher interest rates. Online banking is more convenient too, so this is easy to do.

- Choose the online bank offering the highest yield on savings. This is more difficult. If you’re like me, you’ve looked at sites like Bankrate, Nerdwallet, and Investopedia that compare savings rates. But banks are always jockeying for the top spot. To continue earning the most optimal savings yield, you must continually move your savings from bank to bank (to bank)! That’s impractical.

An example:

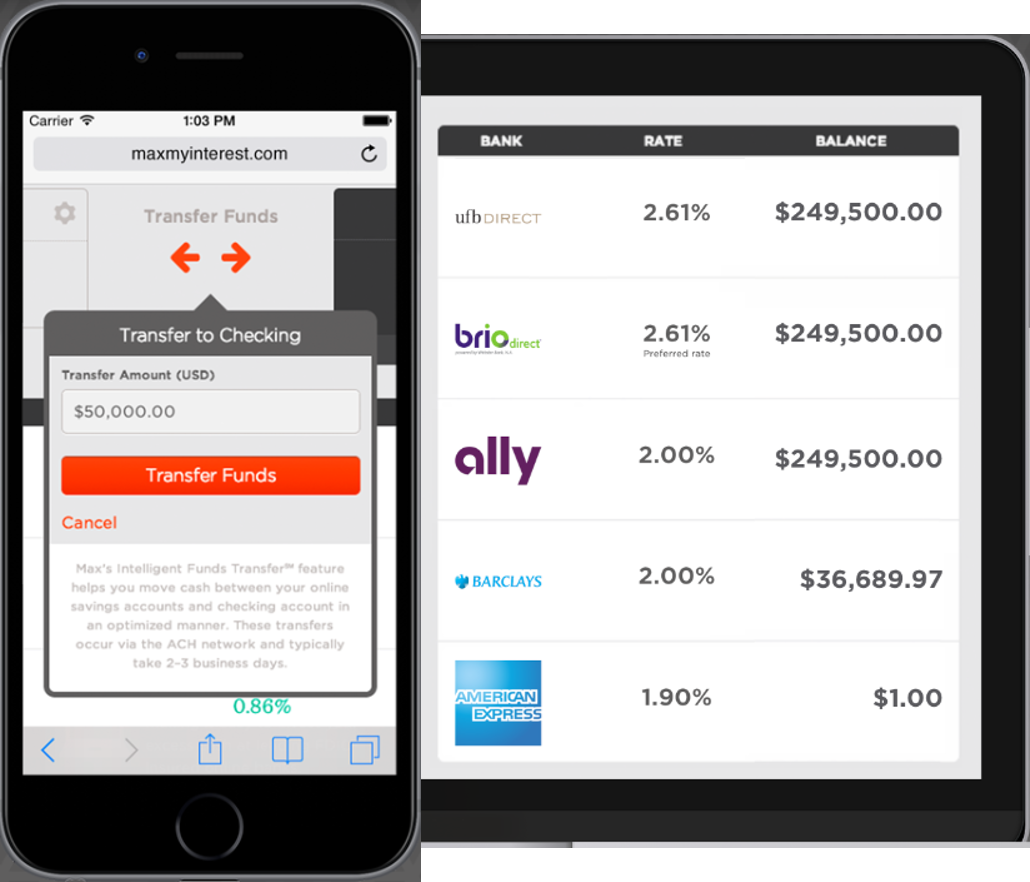

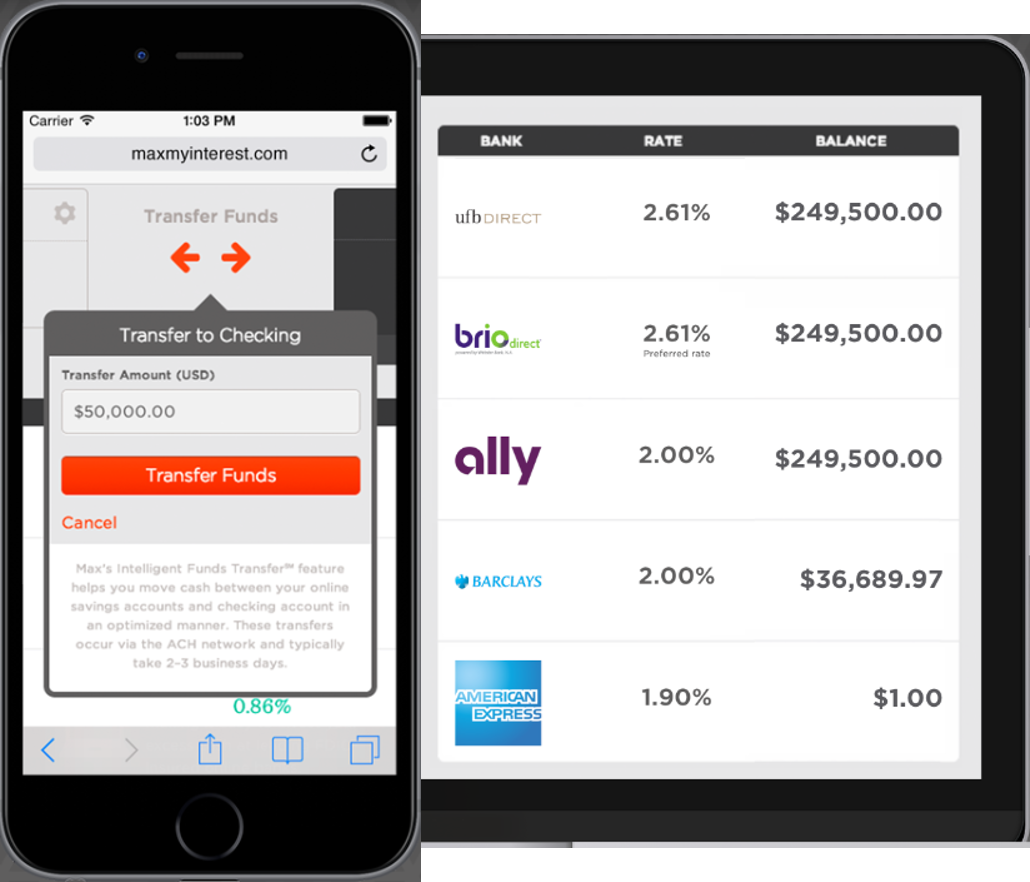

MaxMyInterest or MAX is a service that rotates customers' savings account balances to maximize yields. Always earning the highest savings yield would be too difficult without such a service.

With MAX, you set up a series of savings accounts in your name one time. Then, you pay a fee based on cash savings invested for MAX to move your savings to the highest yielding accounts (in amounts less than $250k) each month.

Here is a list of 18 banks that work with MAX as of this writing:

Ally Bank, American Express Bank, Bank of America, Barclays, BrioDirect by Webster Bank, Charles Schwab Bank, Citibank, Customers Bank, Discover Bank, Fidelity CMA accounts, First Republic Bank, JPMorgan Chase, Marcus by Goldman Sachs, Quontic Bank, Synchrony, UFB Direct, USAA, and Wells Fargo.

My analysis:

With a service like MAX, you can realistically earn a high savings rate each month. Its practicality makes me comfortable analyzing it.

To do so, I’ll take the average of the top 5 high-yielding savings accounts for a given month using the list at Investopedia. By choosing the top 5, I’m making an assumption that while MAX may not achieve the top rate, it will be close. To arrive at a net savings yield, I subtract the fee for the service MAX provides.

This savings option is easy to use. It requires time up front to establish a series of bank accounts. After that, MAX moves money automatically for you each month. If you’re the type of person who likes to optimize your credit cards for points, you could be a fit for this service.

High-yield savings accounts are a valid option for stashing cash. Later, we’ll look at specific, point-in-time yields and fees to help you decide if it’s for you.

Note: Robo-advisors like Betterment, Wealthfront, and Robinhood have a different take on the MAX service. As of this writing, Wealthfront brokerage sweeps uninvested cash among 12 partner banks each offering $250,000 in FDIC insurance ($3 million total). The three Robo-advisors offer yields that are ~85% of the top 5 banks' average savings yield. That’s pretty good, especially given the convenience.

Short-term treasuries (T-bills)

This option for holding cash is Warren Buffett’s favorite. He recommends that the average investor hold cash savings equal to 10% of their portfolio in U.S. Treasury bills.

Unfortunately, I find it difficult for the average investor to hold T-bills. There are three ways to do it, and I’ll examine each.

TreasuryDirect.gov

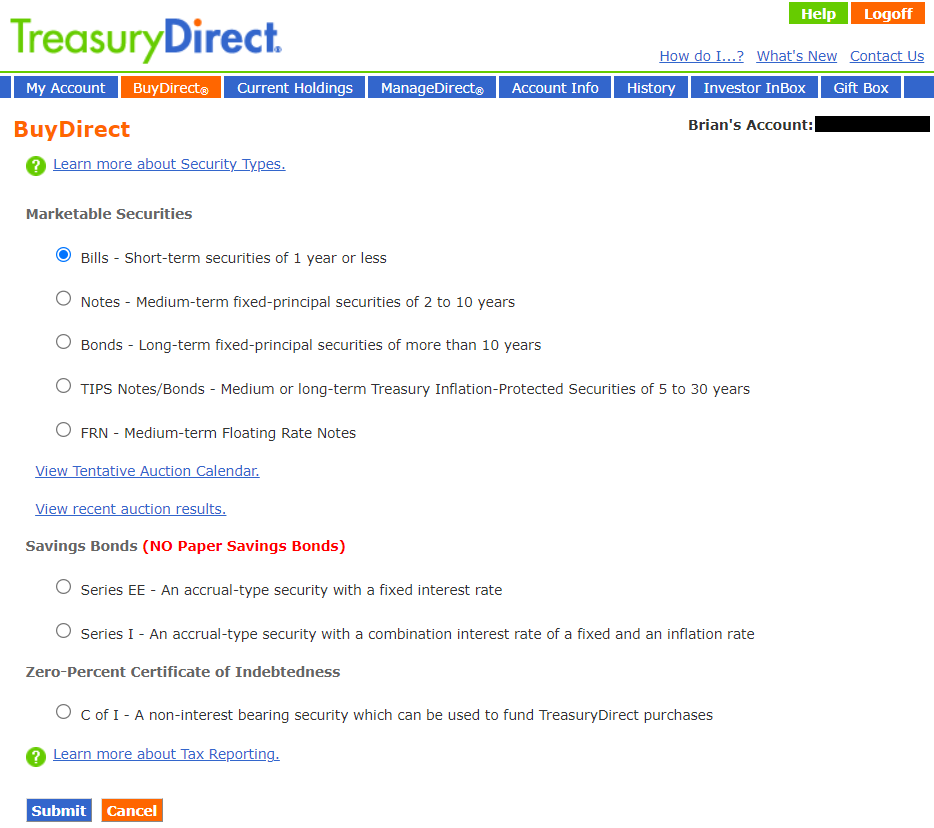

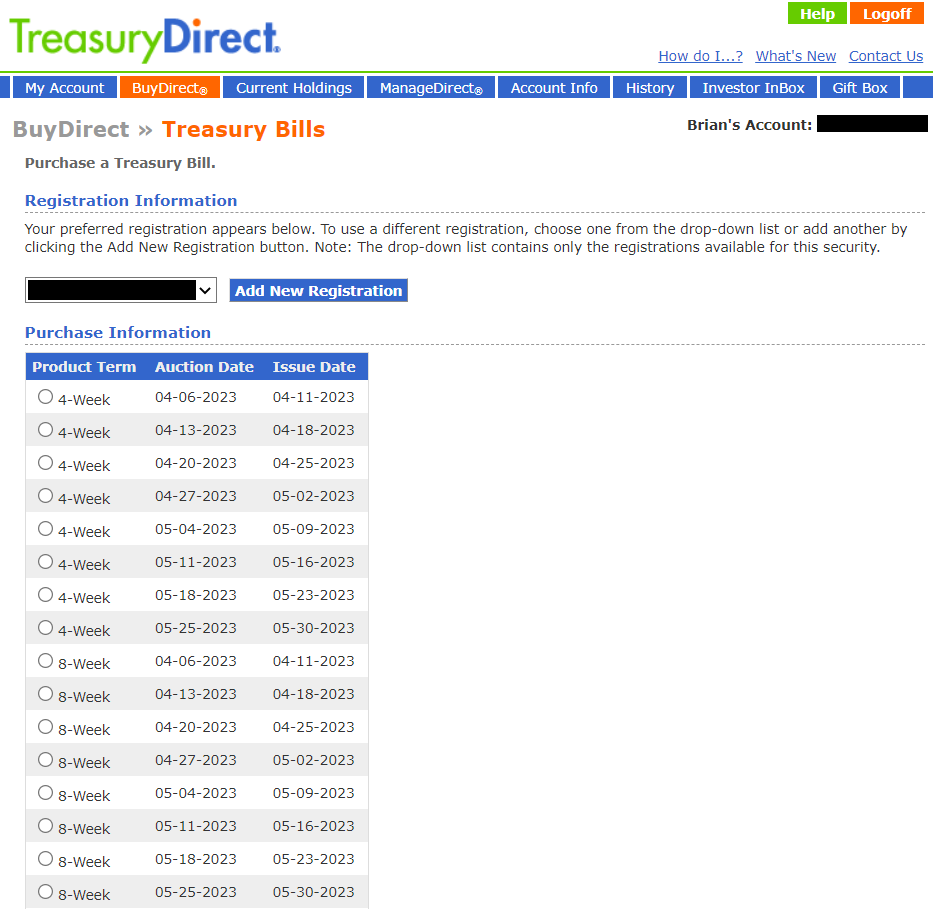

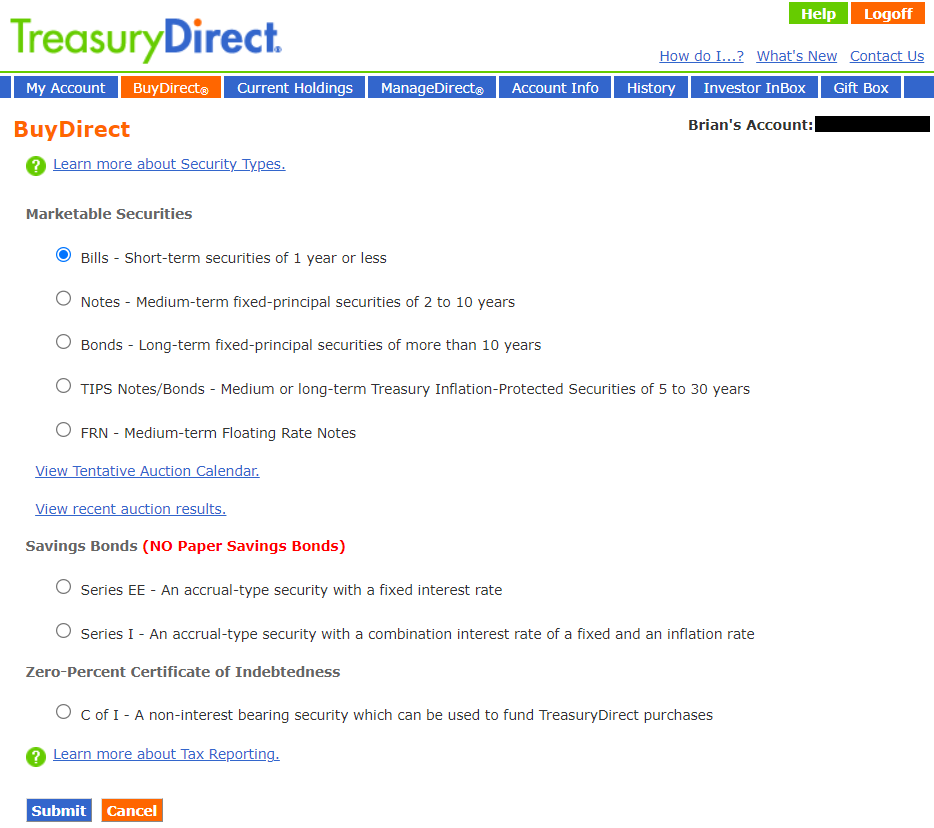

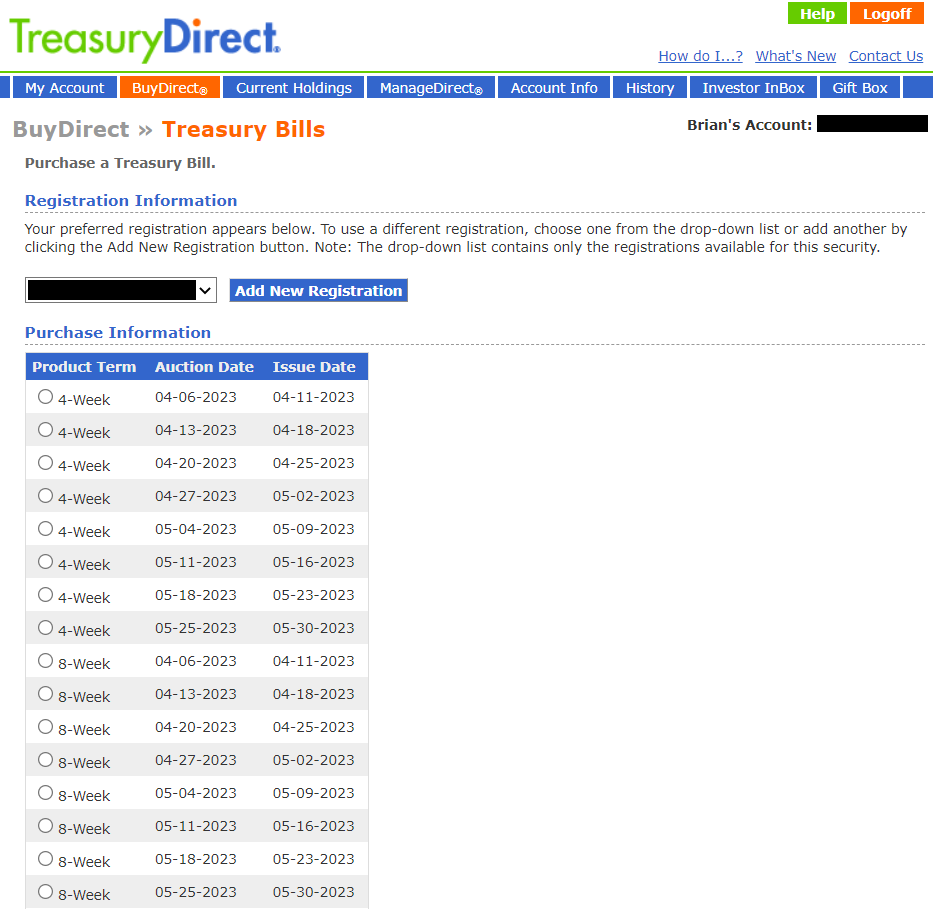

Individuals can buy T-bills directly from the U.S. Treasury in amounts as low as $100 at TreasuryDirect.gov or by visiting a Federal Reserve Bank. First, you must establish an account online with the U.S. Treasury. It is incredibly tedious, and the site looks like it’s from the late 1990s.

Beyond struggling to navigate the site, purchasing T-bills requires a lot of coordination. You must calculate how much to buy, when T-bills come due, and repeat the process monthly (unless you choose auto-reinvestment for up to 2 years).

An example:

This is what it looks like to access a personal TreasuryDirect account.

To log in, enter your password by clicking virtual keys on a keyboard viewable on the screen- it’s clunky! Then, elect to buy Treasury bills. You can buy bills offered in 4, 8, 13, 26, or 52-week durations. The shorter duration bills (up to 13 weeks) have the lowest interest rate risk and are less likely to decrease in value if rates spike. Select Yes to “Schedule Reinvestment” to simplify the process.

My analysis:

Treasury bill rates are pure since the U.S. Treasury sells them directly. The yields are decent. Fees are zero.

The most significant downside to stashing your cash in this way is the inconvenience of it.

- The buying process is cumbersome.

- Treasury bills can be reinvested for up to two years, but that limits flexibility when transferring or selling.

- T-bills are usually held to maturity when bought this way. Assume an opportunity comes along that requires you to invest quickly. You may not be able to access your TreasuryDirect T-bills fast enough and could miss out.

Some finer details:

According to the TreasuryDirect.gov FAQs: “You can transfer any security in TreasuryDirect to an account in the Commercial Book-Entry System. If you hold your security in the Commercial Book-Entry System, contact your broker, dealer, or financial institution or investment advisor. Normally there is a fee for this service.” I couldn’t bring myself to dig deeper to find out more. It’s too complicated.

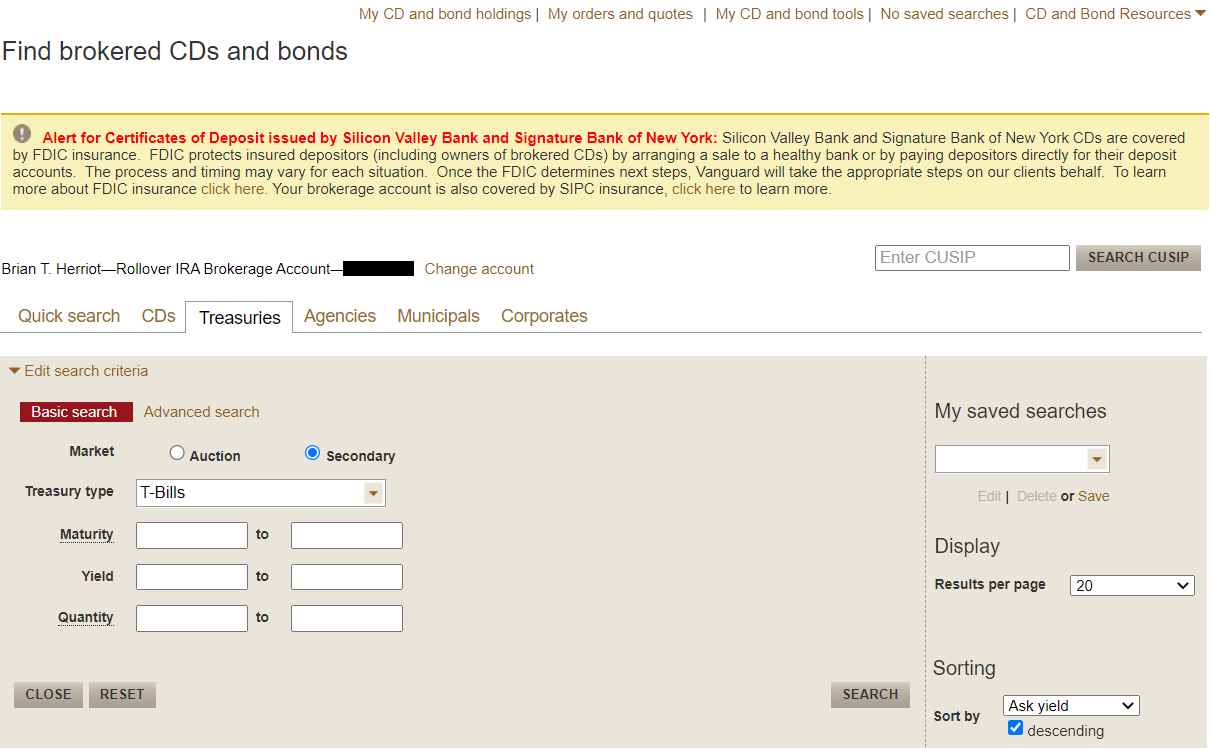

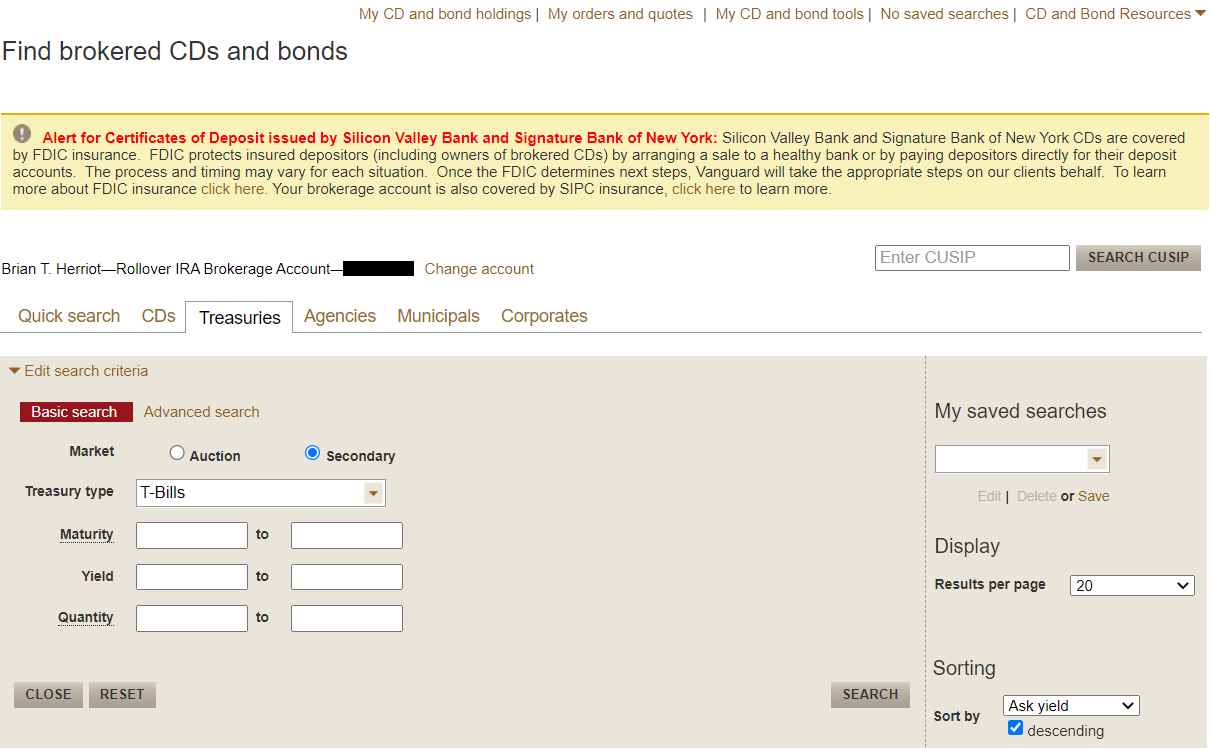

Treasuries via your brokerage

Individuals can also buy Treasury bills within their brokerages (e.g. Vanguard for no fee, or Public.com which charges a small fee). The key improvement over TreasuryDirect is the user experience. Yet, several downsides still exist. And the same complexity exists for selling T-bills before they mature.

From the Vanguard website:

“Vanguard Brokerage doesn’t make a market in Treasury securities. If you wish to sell your Treasury securities prior to maturity, Vanguard Brokerage can provide access to a secondary over-the-counter market.” Complicated.

An example:

This is what you see when you access the “Trade Bonds & U.S. Treasuries” section of the Vanguard Brokerage site.

My analysis:

This method is also very safe and nearly risk-free. T-bill rates are pure, so the yield is decent. Fees are zero at best, and minimal at worst.

The most significant downside continues to be its inconvenience. Your broker’s user interface is likely better than TreasuryDirect. But mine (Vanguard) isn’t much better!

Exchange-traded funds (ETFs) holding T-bills

It is possible to buy an ultra-short-term bond fund to stash your cash.

Buying a low-cost ETF that holds very short-duration bonds is an easy way to own Treasury bills. Treasury bills reach maturity within 1-3 months. So their returns depend primarily on the stated yield (interest rate). The value of the ETF itself can increase or decrease, but not by much.

An example:

Two high-performing ETFs are SGOV and BIL. You can buy both inside a brokerage account.

Why are they great options? Their basic structural factors are sound:

- They have low fees

- They are liquid and easy to trade

- They minimize trading costs

Again, the goal here is to be 100% safe. BIL is the largest in the industry, but SGOV is very competitive and growing.

For a full assessment of both and others, see this link.

My analysis:

The two best options in this space are indeed:

- The iShares 0-3 Month Treasury Bond ETF (ticker: SGOV) offered by BlackRock

- The SPDR Bloomberg 1-3 Month T-Bill ETF (ticker: BIL) offered by State Street Global Advisors

SGOV and BIL buy U.S. Treasury securities which are riskless.

Yields and fees will vary at specific points in time, so I won’t discuss that here. On average, yields are right below the pure yield on Treasury bills. And fees are very low… like “Vanguard bond index fund” low.

Purchasing either ETF via a brokerage account is easy. The funds themselves handle the more tedious purchasing (and selling) of individual lots of Treasury bills auctioned by the U.S. government.

Also worth mentioning for my Vanguard fans: VUSB is Vanguard ultra-short-term bond ETF. But it invests in investment-grade corporate bonds, not U.S. Treasury bills. I recommend not using it.

Money markets backed by the U.S. government

Money market funds aim to keep a $1.00/share value and pay a 7-day yield in line with the short-term Federal interest rate. You can buy money market funds at your brokerage. Some even offer check-writing features.

A convenient way to own them is via the “sweep” account inside your brokerage. The sweep account is a money market account that holds excess cash after making other investments. For example, let’s assume you have $5,000 available to invest and buy shares in a stock ETF worth $4,960. Your remaining $40 flows to your sweep account, earning interest at the money market rate.

An example:

If you invest at Vanguard, you’ll recognize that it has replaced its sweep account within the last few years. Its Prime Money Market is now the Federal Money Market (VMFXX). And 99.5% of VMFXX’s invested assets are U.S. government-backed. It’s very safe!

Fidelity’s sweep account is its Government Cash Reserves (FDRXX) and is also 99.5% guaranteed.

My analysis:

Let’s assess VMFXX and FDRXX. Both are extremely safe and essentially riskless given their federal government backing.

Yields and fees will vary at specific points in time, so I won’t discuss them yet. Like ultra-short-term bond funds, yields are usually right below rates on Treasury bills. And fees are very low, especially Vanguard’s VMFXX.

The big “watch out” is if you use Schwab for your brokerage. Schwab’s sweep account pays much, much less. Schwab’s business model relies on earning a spread on customers' sweep accounts. (Vanguard and Fidelity do not. Their business models rely on fees from mutual and exchange-traded funds.)

Stashing cash in your brokerage account without having to buy a money market fund separately is extremely convenient.

This assumes that you do not use Schwab as your brokerage. In that case, you could buy a money fund with cash available in your sweep account. It’s a bit less convenient. If you must stay in the Schwab ecosystem, I would buy the Schwab Government Money Fund (ticker: SNVXX). If not, the Vanguard Federal Money Market Fund (ticker: VMFXX) is a better option.

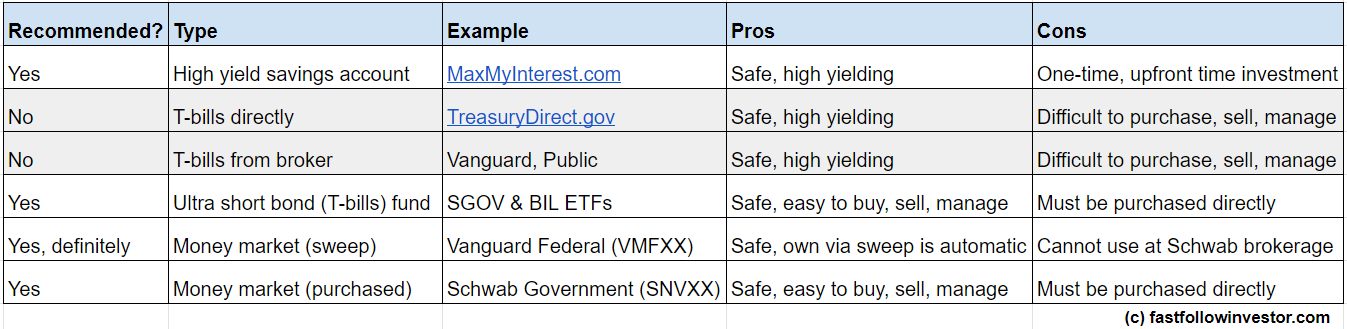

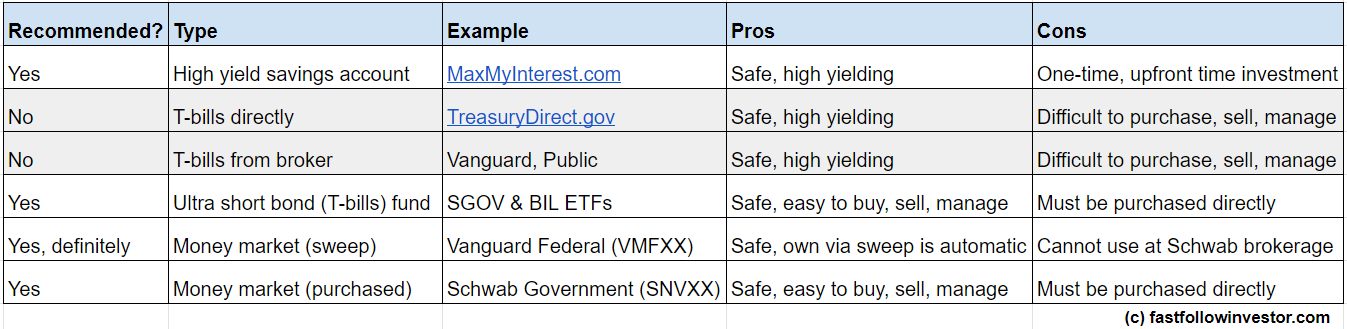

Summary and recommendations

All options for stashing cash discussed so far are safe. To pick the best solution, look at net yield and ease of managing the account. Individual situations (e.g. the institution that holds your brokerage account) also play a factor.

Here is a summary and also my recommendations.

Strong choices:

Best

A money market sweep account is the absolute easiest way to earn a very safe, near-riskless, strongly competitive net yield on your cash. It works best for those using Vanguard’s brokerage. It’s pretty darn good for those with a Fidelity brokerage account. It is so easy, you don’t even need to think about it.

Very good

After a one-time set-up, optimizing cash holdings across many savings accounts is a very good solution. This works best if you’re the type of person who likes optimizing your use of credit cards for points. If you are, you should investigate MaxMyInterest.

Very good

Two other good choices are buying:

- The highest-yielding (net) money market fund

- An ultra-short-term bond fund holding government securities

Both require a bit more work. You should look across products to understand net savings yields at specific points in time. To make it easy, I do this for members of the Fast Follow Investor community. If you’re interested, you can sign up here. This solution works best if you cannot drop Charles Schwab as your brokerage.

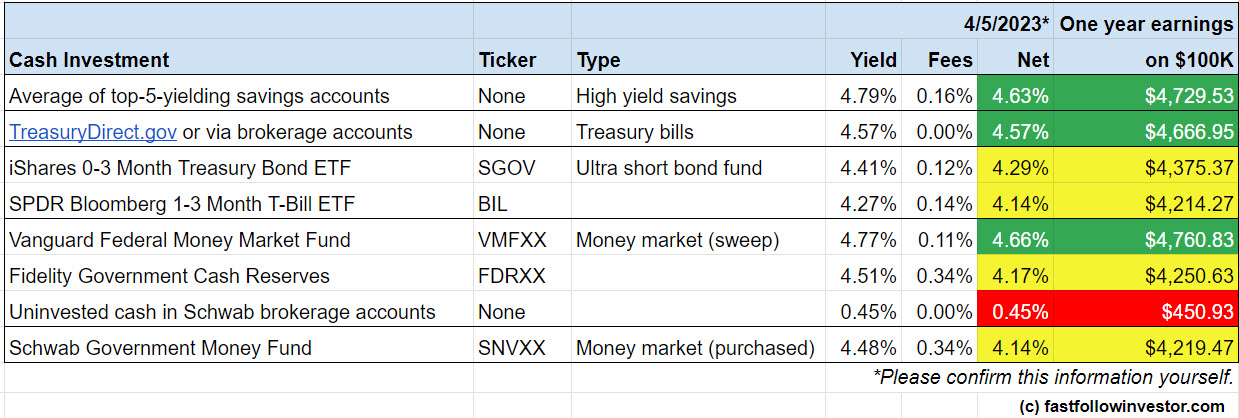

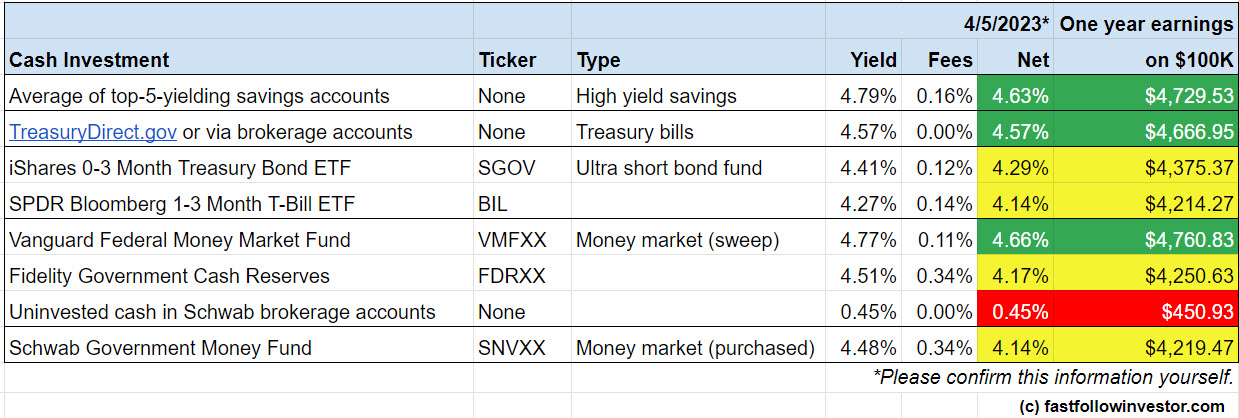

Point-in-time analysis: April 2023

Here is a summary of net interest yields as of April 5, 2023.

The highest-yielding cash investments (after fees) are:

- Top high-yield savings accounts

- Treasury bills, themselves

- Vanguard’s Federal Money Market Fund

Highlighted in green, each is averaging ~4.6% net yield.

The worst yield is Schwab’s sweep account. Schwab’s “uninvested cash in your brokerage or retirement accounts” yields 0.45% net interest.

When choosing your optimal cash savings solution, always consider:

- Current net yields

- The ease of managing your cash savings

- Your personal situation, like where you maintain your brokerage

Links to cash investment product research:

And always remember: this analysis is in no way financial advice. It’s financial education.

Determining how much cash to hold

Before diving in, let’s take stock of what we know.

- Cash provides a great cushion in bad times. It helps us be opportunistic when investments go on sale after a market loss.

- Many great investors have used cash to take advantage of turbulent times in U.S. markets. We should too.

- There are many places to hold your cash. The most convenient and highest yielding (net) are:

- Brokerage sweep accounts (not Charles Schwab)

- Other low-cost money market funds

- Ultra-short-term bond funds that hold Treasury bills

So, now: How much cash should we hold?

The short answer:

It depends on your personal situation and what opportunities exist to earn better returns.

A better answer:

How about a general rule gleaned from the greatest investor of all time?

- Warren Buffett recommends that investors hold 10% of their portfolios in safe, short-term Treasury bills or “cash”.

- Meanwhile, Berkshire Hathaway holds up to 20% of its investment portfolio in cash. Over time, its cash holdings have averaged 10-15%.

So, a general rule of thumb:

Hold 10-15% of your investment portfolio in cash, on average. Hold up to 20% when markets become overheated.

The best answer:

A detailed analysis can be conducted at certain points in your investing journey.

- First, we’ll examine someone starting out (small investment portfolio).

- Then, we’ll examine someone late in their investing journey (large investment portfolio).

Emergency fund and more

This is especially important when early in your investing journey.

Many personal finance pundits recommend building an emergency fund. Do this immediately after paying off non-mortgage debts. This is good advice, but for different reasons than often cited.

Financial advisors recommend putting aside 1-3 months of living expenses into cash savings. Some suggest 3-6 months and others 6-12 months. Its purpose is to “give you a cushion to find another job”.

But I look at an emergency fund differently. I’m solving for something even more important.

Let’s flip this scenario on its head: A job loss (whether forced or chosen) is not negative. In fact, it can be a huge opportunity. So, how can you position yourself to be ready?

I recommend saving up to 3 years of living expenses. Why so much? It’s not because it will take you 3 years to get a job. If you read this blog, you are smart and resourceful.

I recommend extra cash savings for two reasons:

- The savings give you time to find the right job which may take longer than 3 months. The right job is one that builds the essential skills you need to go into business for yourself. These are skills like sales and marketing, programming, finance, leadership, and management.

- With 3 years' worth saved up, perhaps now is the time to start your micro-business! Don’t worry if you’ve lost your job in a poor economy. There is no better time to start a business. Difficult times reward only the best ideas, and talent is available and cheap.

An example:

Assume an individual is early in her investing journey. With a $150,000 portfolio where she spends $60,000 a year, she should continue saving ($30,000 more). Save until reaching $180,000 (3 years of expenses) in cash before investing in retirement and other higher-yielding accounts.

As shared earlier, this is not what I did in 1997 when starting my career. Instead, I maxed out my 401(k). But, I wouldn’t do it that way again.

- I got lucky by saving during the second 20 years of a 40-year bull market. I got lucky while having no meaningful cash savings cushion.

- Also, retirement savings is slow growth savings. When you are young, you have a chance to hit it big. So, start that micro-business. Maybe it will turn into a big success.

Opportunistic mountain of cash

This is especially important when late in your investing journey.

I’ll start this analysis in the same way. Many personal finance pundits recommend staying fully invested. This means holding only enough cash for a small emergency fund. They say that cash savings' low(er) yield is a drag on your investment portfolio.

Why hold cash when it drags down your return for most of the time you hold it?

Again, let’s flip this scenario on its head. A stock market loss is not a bad thing! It can be a huge opportunity. So, how do you position yourself to take advantage?

I recommend saving up to 20% of your entire investment portfolio in cash. Why so much?

I recommend holding extra cash for two reasons:

#1 - If you are later in your investing journey, you are close to retirement. Holding extra cash reduces the chance you must withdraw from investment accounts when they are down. This is called sequence of returns risk. (Please ignore that confusing term. The term is not important.)

If you invest alongside the Fast Follow Investor portfolio, any negative drawdown in value will recover within 3 years. Thus, if you can cover 3 years of living expenses and not withdraw from investments, you’re set.

This is especially helpful during the “retirement risk zone”. The risk zone is the 5 years before and 5 years after your retirement date. If you are heads-down saving and investing, you likely haven’t thought about this 10-year span. But, it will make or break your retirement.

- In the 5 years before retirement: Should the market fall, you risk not reaching your savings goal. The solution? Work longer :-(

- In the 5 years after retirement: Should the market fall, you risk withdrawing savings as your balances decline. The solution? Go back to work :-(

#2 - You can be greedy when others are fearful. Having cash after markets drop lets you buy wonderful investments on the cheap! Selecting high-performing investments during market downturns is smart.

An example:

Remember the individual from the earlier example? Assume she is now further along on her investing journey. With a $2 million portfolio where she spends $120,000 per year, she should save up to $400,000 (20%) in cash. Invest the remaining $1.6 million (80%) of her portfolio in Fast Follow Investor or buy & hold indexed investments.

This is what I’m doing. Apart from the pure financial arguments for doing so, having cash on hand helps me emotionally. I sleep better at night. I’ve learned it is really hard to stomach large portfolio swings of tens and sometimes hundreds of thousands of dollars as markets move…and I’m a pretty even-keeled guy. I have to think that holding cash will help you too.

That said, I don’t recommend stashing any more than 20% in cash. Greater expected returns are indeed found elsewhere. This argument is absolutely valid. Your wealth growth will lag with a cash position greater than 20%.

Real-world considerations drive exceptions

In the earlier example, I recommended holding between $180,000 and $400,000 in cash throughout life. When could it be less?

While there are no hard and fast rules, I can offer several situations to consider. There is nuance here (as in most areas of life).

The first two consider opportunities. Here, you play offense with your cash.

- You spend it to pursue the opportunity you’ve been saving for. Then, build your cash savings back up. In the early-stage example, she’s saving $180,000 to start a micro-business. Once she hits that milestone, she should go for it!

- Suppose investors have a sour taste for stocks after a severe decline (e.g. the Great Financial Crisis of 2008-9). When markets are undervalued, it is smart to move cash to investments with higher expected returns. In the late-stage example, she could move much of her $400,000 savings into a passive stock index fund. She should certainly do it if the Shiller PE (CAPE) Ratio shows the market is on sale.

The next two consider the insurance that cash provides. Cash is defensive, but how much insurance do you need?

- You have passive income that covers some living expenses. Let’s say that our early-stage saver generates $80,000 in passive income to help cover $180,000 of expenses over 3 years. In that case, she need only save another $100,000.

- You have access to cash that you might pay interest on in the short term. But it keeps you from withdrawing from investment accounts.

Some examples are:

- 401(k) - You can withdraw as much as 50% of your savings, up to $50,000 within a 12-month period. Double it if your spouse has an account.

- Cash value life insurance - I don’t recommend you get it. But if you happen to have it, you can borrow against it.

- Home equity line of credit - Be sure to get your credit line in good economic times.

There are other options too. But I don’t recommend credit cards…the interest you pay is too high.

In the late-stage example, assume she borrowed $100,000 in total from her 401(k) and her spouse’s 401(k). Instead of holding $400,000 in cash, she now needs only $300,000 or a little more to account for interest charges.

In summary, I recommend holding cash in an amount greater than 3 years of living expenses or 20% of your investment portfolio. Your cash will drop upon pursuing an opportunity where you have an edge. This could be a micro-business or other higher-yielding market investment. You can also get away with holding less if you have access to cash through a 401(k) or cash-value life insurance policy.

Cash savings summary

We have covered a lot. And now you know the importance of cash savings when ascribing to the Idols Framework for building wealth.

- Cash is defensive and opportunistic.

- Historically, it’s generated huge wealth in turbulent economic times.

- It has never been easier to generate great returns using high-yield savings accounts, ultra-short-term bond funds, and money markets funds. If you have the right brokerage, your sweep account handles it automatically.

- And we optimized how much cash to hold given the stage of your investing journey.

Cash is king! Don’t let anyone tell you otherwise.

Related posts

Read more about the Idols Framework for wealth creation.

Subscribe to get my posts sent to your Inbox. Thanks!

What is Fast Follow Investing?

- Start with buy & hold passive indexing.

- Then, 1) expand beyond stocks and bonds and 2) cut off severe market losses at the knees.

- Grow your lifetime savings at 12% to enjoy a 5% forever rate of withdrawal in retirement.

- Fast Follow Investing (based on Tactical Asset Allocation) is finally here for small investors like you and me.

So join me!