Many of you have asked how to invest like me. You are interested in diversifying a portion of your investment portfolio.

Here is why and how you may choose to match my trades:

I’m in my mid-forties now. So, during the market crashes of 2000-2002 and 2008-2009, I kept saving -using my 401k and IRAs- because markets would eventually recover.

And they did.

But it was easier then. Retirement was far away.

Ten years passed. I had more savings. I joined the Financial Independence Retire Early (FIRE) movement and early retirement was in the cards.

Then, the Covid crash of March 2020 hit.

Watching my savings drop by $300,000 hurt. Bad. Luckily, the market rebounded. But, then I made a mistake.

When the market reached its pre-crash level, I moved everything to cash…only to watch the market rise another 50%. Oh well.

Moving to cash cost me a lot of money. But from it, I gained new insights.

I found an investment model that honors everything I respect about John Bogle and the FIRE movement: DIY, owning the market, low costs, and long-term thinking.

The model holds on in times with significant gains but also protects me from steep losses. I must no longer accept “market risk”.

It’s a form of quantitative trend investing called tactical asset allocation (TAA). I used TAA models to build my Fast Follow Investor (FFI) strategy.

I trade monthly across all major asset classes: stocks of all types, bonds of all types, commodities, gold, real estate, mortgages, and cash.

Trades are based on mathematical models that match short- and long-term market trends. The models ride winners and cut losers.

The evolution of low-cost ETFs, no-cost trades, and tools like Allocate Smartly allow small investors like me to mimic strategies once available only to professionals.

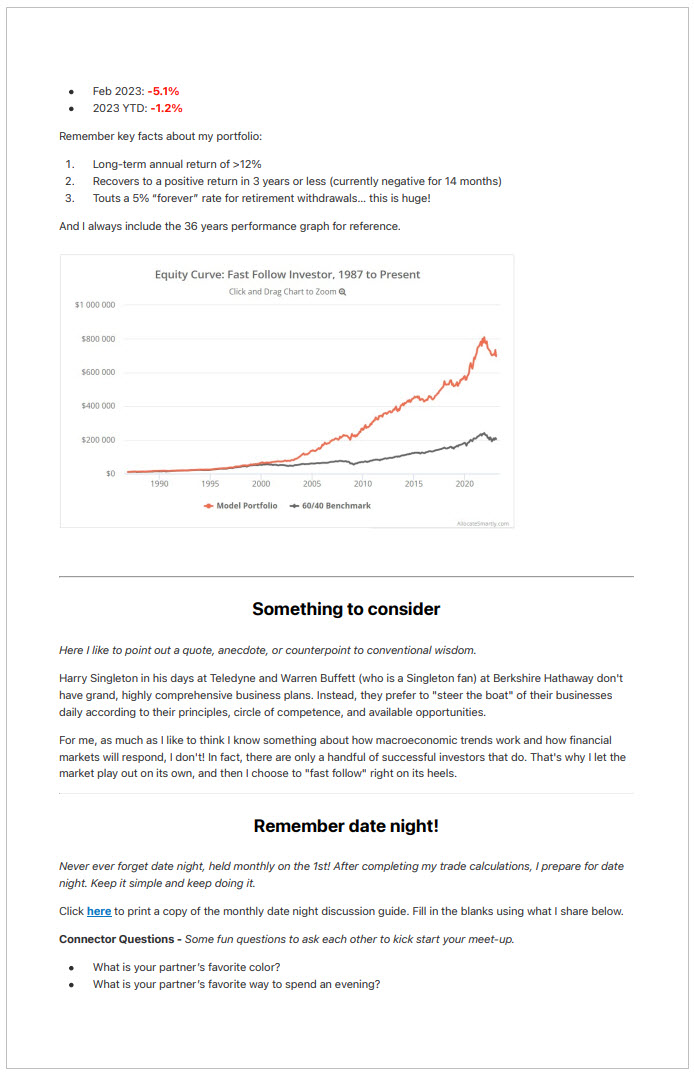

My model is rooted in forward-looking financial truisms, though when backtested to 1987, shows:

- Annual investment return of 12.6%

- Maximum yearly loss of 13.4%

- Never more than 16 months “in the red”

When you become a Fast Follow Investor, you'll join a community of like-minded, smart investors in pursuit of financial freedom.

Each month I will send you:

- New ETF allocations for the month and buys/sells I will make

- Some commentary on how FFI is reacting to the markets

- An investing lesson that is often a quote, anecdote, or counterpoint to conventional wisdom

Here is a sample email:

This offer is in no way financial advice. Rather, it is very important financial education!