This page consolidates the 6-email education series for Fast Follow Investor members. Use this page as a quick reference. And refer to it often!

[Introduction: Email #1]

What to expect from the Fast Follow Investor education series

#1 Introduction - I will explain why Fast Follow Investing has a place in every investor’s portfolio. It is a pillar of my Idols Framework for building wealth. Also, I define the strategy and provide a TLDR overview.

#2 Tactics - First, I share the investment tracking spreadsheet that I use to get set up for monthly ETF trading. Next, I describe how I share monthly changes to my portfolio plus how and when to make trades.

#3 Foundation - I describe the funnel of strategies leading to the Fast Follow Investor model. First, quantitative systems, then trend-following, and next Tactical Asset Allocation. I touch on some technical details for those who are more analytically minded.

#4 Focus - I use an application called Allocate Smartly to model the Fast Follow Investor portfolio. I define a “top 10%” Tactical Asset Allocation strategy and recommend the best 5 strategies on the Allocate Smartly platform.

#5 Fast Follow Investor model - I assess the Fast Follow Investor model by reviewing its historical performance. Yet, the true beauty of the model is its positioning for future (unknown) events!

#6 Go forth! - I describe 3 practical considerations to address when investing this way. Then, I recommend an approach to gain confidence in the trading strategy. Build your skills while controlling your risk. You’ll soon be unstoppable.

The business case for Fast Follow Investing

Have you ever stumbled onto something that feels magical? Remember the first time you used Shazam to identify a song? Magic. How about seeing Google Streetview (with people’s faces blurred)? Or better yet, when you went “flying” on Google Earth? That was crazy to me! I read about the unveiling of the first Polaroid “instant photography” camera in 1947. People went wild…their minds were blown. I’m sure you’ve had similar moments.

“Where has this been all my life?!” That is what I asked myself after finding Fast Follow Investing. Why?

- It’s got superior results no matter the future. Stocks up? Stocks down? U.S. down? International up? Who knows, but it doesn’t matter! Fast Follow Investing works no matter the economy.

- It’s easy to put in place, so my day-to-day attention can be elsewhere. (I can build a great business or focus on my personal relationships). Fast Follow Investing takes only 2 hours a month.

- It gives me control that I didn’t think was possible. Control is what I crave as a micro-business owner. So, it makes sense that I also crave control as a Fast Follow Investor.

Enough about why to invest this way…what is Fast Follow Investing?

Fast Follow Investing tracks a mathematical model that invests in exchange-traded funds (ETFs). The model calculates buy and sell decisions based on price trends. A price trend measures how much the price, on average, is moving up or down. The underlying investment strategy is Tactical Asset Allocation.

The Fast Follow Investing model generates stock-like investment returns (12%+) as we pursue financial independence.

Then, Fast Follow Investing protects against severe losses, so we sleep well once we become financially free.

Please pay attention to this part, because it was a question of mine early on: Why now? Why is this the first time I’m hearing of Fast Follow Investing? Or Tactical Asset Allocation? Or even quantitative trend investing?

Thanks to the evolution of low-cost ETFs, no-cost trading, and tools like Allocate Smartly, individual investors like me can mimic strategies once available only to professionals.

For us, access to this type of investing is only 5 years old. As individual investors, we are early to the game! But the strategy is time-tested with proven success. Professional hedge fund investors have refined it over the years. We can ride those successes…

The TLDR overview: what you absolutely must know

The Fast Follow Investor model:

- Tracks market indexes and not individual stocks, using low-cost exchange-traded funds (ETFs)

- Chooses from all types of investments: stocks, bonds, real estate, gold, commodities, and cash

- Requires no expertise or personal judgment about the direction of markets. In fact, it demands that you don’t try to outsmart the mathematical models

- Works in all economies (growth, recession, inflationary) not only those seen recently

- Rides extreme market gains, often well into bubble territory

- Yet, protects against severe market crashes by moving money into a safe haven

- As a Fast Follow Investor, I don’t start an investment trend, but instead, jump in on the trend quickly.

In other words, as a Fast Follow Investor:

- Every month, the mathematical model looks at the entire investment landscape.

- The model adjusts how my monthly portfolio is allotted, similar to rebalancing… call it “opportunistic rebalancing”.

- Money shifts into investments expected to grow and out of those expected to shrink.

I’ve thought a lot about why this feels magical to me.

The Fast Follow Investor model honors everything I respect about John Bogle and the F.I.R.E. movement. The model is do-it-yourself, owns the market, keeps costs low, and skews long-term.

Then it adds two very simple, yet vital ideas that, for me, were blind spots. If you remember nothing else, remember these two points! This is how Fast Follow Investing wins over time.

- Broaden investment options to help find winners in any economy (e.g. gold, commodities)… Why had I limited my options to only stocks and bonds?!

- Cap investment losses by selling before investor fears sink prices even more (losses are asymmetric!)… I now know why structured, disciplined rules for selling investments are crucial.

Fast Follow Investing is magical because it adds a layer that is so simple and obvious, yet completely new to me. The result: Higher returns with less risk.

Yes, it is possible to have cake and eat it too! We can achieve stock-like returns with bond-like risk. Next, I’ll show how this is possible.

[Tactics: Email #2]

Get set up now before the end of the month

Do this once. It takes 30-60 minutes.

Create your personalized monthly trading spreadsheet! First, copy the template I provide. Then, update it with your investment accounts.

The template to copy (with instructions included) is here.

Expect an email from me at the end of each month

Watch for an email from me within two hours of the market closing on the last trading day of the month. In it, I will share the ETFs that I will own for the next month.

Here is a sample email:

Monthly trades

I’m making these changes this month.

My portfolio changes summarized:

- Drop US Mortgage REITs: ~10% 🔽

- Reduce International Stocks: ~10% 🔽

- Reduce exposure to Gold: ~25% 🔽

- Increase Cash, once again(!): ~45% 🔼

In March, my Fast Follow Investor portfolio will be ~35% international stocks, ~15% gold, and ~50% cash.

Prepare and place ETF trades each month

Do this monthly. It takes 30-60 minutes.

Before the next trading day (the first trading day of the next month), update your trading spreadsheet. Calculate the ETFs you choose to sell or buy (in that order).

Thirty minutes following the market open, place your trades.

Monthly trading instructions

Determine trades

Trigger:

The market closes on the last trading day of the month. Soon after closing, you receive an email from me. At that point, you prepare to execute trades the following trading day, the first of the next month.

Instructions:

- Open my email (see above for a sample) that specifies my ETF investments for the new month. Find the column “Allocation %, New” field, shaded yellow.

- Open your personalized Fast Follow Investor trading spreadsheet and find the new month.

- Record the allocations from the email into the respective field in your trading spreadsheet: “Allocation %, New”, shaded yellow.

- Log in to your investment account(s) and capture those ETFs you currently own and the value for each.

- Record these amounts in the corresponding cell in your trading spreadsheet: “Current Values/Account 1, 2, or 3”, shaded yellow.

Note 1: You might have many investment accounts (e.g. Self and Spouse 401Ks, Rollover and Roth IRAs, or more) that you trade as a group within a single portfolio. Use the “Account 1, 2, 3” columns to capture this.

Note 2: If you have completely separate portfolios, create a unique spreadsheet for each. For example, I manage 3 portfolios: retirement (6 accounts/ 1 spreadsheet), taxable (1 account/ 1 spreadsheet), and my son’s investments (1 account/ 1 spreadsheet).

- Next, the trading spreadsheet compares the ETFs you currently own with those you should own. It calculates buy amounts (shaded green) and sell amounts (shaded red).

- Finally, look at the subtotals row (shaded gray) to confirm that all calculations check out.

Make trades

Trigger:

The market opens on the first trading day of the month. At this point, use your spreadsheet to execute trades (sell, then buy) within your portfolio.

Instructions:

- Wait 30 minutes until the market settles overnight trades (~10AM Eastern Time). Then, access your brokerage account on your preferred trading platform (e.g. Vanguard, Fidelity, Schwab).

- Place all sell trades first as “market orders”. If necessary, enter the dollar value of the trade to calculate the number of shares to sell.

- Place all buy orders, also as “market orders”. If necessary, enter the dollar value of the trade to calculate the number of shares to buy.

Note 3: When buying, I recommend rounding down to the nearest $1,000 or so. By not rounding down (and without a margin established on your trading account), you run the risk of buying without funds in your sweep account. I made this mistake one time, and Vanguard restricted my trading account for 3 months.

- Confirm that your respective trading platform has processed all trades.

Refer to detailed monthly trading instructions here.

Congratulations, you did it! I hope you feel the same way I do. I’m always rejuvenated after monthly rebalancing. Is that weird? :-)

[Foundation: Email #3]

Basics of quantitative systems, trend following, and Tactical Asset Allocation

Let’s define 3 investment strategies to help guide us to the Fast Follow Investing model.

#1 Quantitative/mathematical strategies

This broad category covers mathematical trading performed by computer programs. Quantitative strategies have given rise to high-frequency trading firms, algorithmic trading platforms, and statistical arbitrage trading methods. (Excuse me, what?) Fear not, there is just one algorithmic trading strategy we care about…

#2 Trend-following

Trend-following strategies have been around for over 100 years. The ability to execute them programmatically has led to their growth.

To understand trend-following, we must understand the simple moving average (SMA). The SMA for a stock is the average price that all traders have paid over a set # of days. There are many variations. E.g. a short-term trend is the 50-day (10-week) SMA; a long-term trend is the 200-day (40-week) SMA.

When the current price moves above the SMA, investors buy the stock. When it moves below the SMA, investors should sell it. In short, trend-followers buy on an uptrend and sell on a downtrend. Trend-following smooths out volatility and lowers risk.

There are many strategies that trade using trend-following: commodities only (Commodity Trading Advisor or CTA), complicated technical analysis, buying/selling individual stocks, and shorting downtrends. It is not important to understand these, because…

These strategies are too narrow, too risky, and too complicated for the do-it-yourself investor like me. There is just one we care about…

#3 Tactical Asset Allocation

This trend-following strategy builds (allocates) a diverse set of investments (assets) using exchange-traded funds (ETFs). The ETFs track indices of stocks, bonds, real estate, gold, and commodities.

Each month, investors buy and sell ETFs to capture the best-trending investments at that time.

Trades based on mathematical models match short and long-term market trends for these investments. The models ride winners and cut losers. They buy investments in up-trending markets and sell when returns turn negative. The strategy has a good offense allowing unlimited upside and a good defense by minimizing losses. For more details, see my post on winning the investing game.

The result: Fast Follow Investing

At last, the Fast Follow Investing model selects from the best Tactical Asset Allocation strategies available on Allocate Smartly.

What is “the best”? Not past performance! In fact, best means how well the strategy can react to future economic conditions. It generates the highest return and lowest risk through expansion, recession, and inflation. The goal is to withdraw savings at a rate that exceeds the 5% Forever Rule. More on exactly how I do this in future lessons…

The Fast Follow Investing model I use is a portfolio of the best 3 strategies on Allocate Smartly.

Technical details for those analytically-minded (like me)

Four mathematical & statistical principles are foundational to Fast Follow Investing.

Option theory

“Be opportunistic!"

The rule: Always keep the greatest # of options open for the longest possible time.

Fast Follow Investing trades all publically-available investments except currencies. (Currencies cannot trade in this way, right now.) Also, private assets are not priced-to-market value often enough to trade monthly. But, this still leaves a wide range of investments.

Loss asymmetry

“Manage risk!"

The rule: Cap your losses because recovering is harder. An example: a 50% loss requires a 100% gain to break even. That’s not symmetrical!

Fast Follow Investing sells investments that are trending very negatively to cap losses. This is in line with Warren Buffett’s two rules of investing: “#1 Don’t lose money. #2 Remember rule 1.”

Mean reversion

“Seek value!"

The rule: The price of an investment eventually returns to its average price over the long term.

In Fast Follow Investing, we emphasize investments priced below their long-time averages. Extreme values tend to return to averages.

Serial autocorrelation

“Ride the wave!"

The rule: A current price depends on its past price. And this relationship helps predict the future price. Prices over time are not random.

The Fast Follow Investor model is rooted in trend-following. It adheres to the rule that trends tend to continue more likely than stop or change direction.

Now, you understand quant investing, trend-following, and Tactical Asset Allocation. You also know the four mathematical principles foundational to these strategies.

[Focus: Email #4]

Each month, I declare the revised Fast Follow Investor portfolio. As you know, I signal trades to make (both buy and sell) on the morning of the first trading day of the next month.

How do I arrive at those trades? In the next 3 lessons, I will describe how I derived and applied the Fast Follow Investor model. In doing so, you’ll learn why I see it as the optimal way to invest for financial freedom.

Each month, I use a service called Allocate Smartly to adjust my portfolio. You can too. It provides a great platform to “tinker” with Tactical Asset Allocation strategies. As of March 2023 (the last time I looked), Allocate Smartly tracks 74 tactical strategies.

It’s easy to go down a rabbit hole. Using Allocate Smartly well requires mathematical and financial know-how that you may not have time for… Some of us are personal finance and investment nerds. Some of us prefer to pursue other interests. :-)

I love doing the work, the work that your annual membership allows me to do. But, if you want to use it, please let me know! The Allocate Smartly subscription is $399 annually. If I refer you, I can earn a small percentage of your sign-up fee. (Thank you!)

Characteristics of a “top 10%” Tactical Asset Allocation strategy

Central to creating the Fast Follow Investor model is identifying the best strategies on Allocate Smartly. I assess each strategy on several factors to classify the “top 10%”.

A “top 10%” strategy takes advantage of the four mathematical principles we reviewed. They are option theory, loss asymmetry, mean reversion, and serial autocorrelation.

I assess each Tactical Asset Allocation strategy looking forward, not backward based on performance.

Beware: It is tempting to optimize a strategy to produce the best historical performance, and Allocate Smartly has the tools to do it.

I pay particular attention to the two key features of tactical strategies. I’ll introduce them here and then use both to analyze the Fast Follow Investor model in the next lesson.

- The strategy can thrive in every kind of future economy we experience. Many strategies look good, but only for the incredible returns of bonds and stocks in the past 40 years. A “top 10%” strategy handles economic expansion, recession, and inflation. To handle this, the strategy must access all types of investments. Poor strategies have limits. They cannot access gold or commodities, for example.

- The strategy protects against severe losses. For example, in 2022, the Federal Reserve raised interest rates steeply. The result? Almost no investment grew (stocks, bonds, gold, commodities). Only the U.S. dollar rose. In these very rare times, a “top 10%” strategy can shift the portfolio to cash to limit losses. Some strategies don’t allow for this.

In summary, the best strategy finds undervalued, up-trending ETFs among a wide range of investment options, including cash. When everything aligns, you have a winner. When the market falters, the strategy survives with minimal losses until times improve.

The best 5 (of 74) models on Allocate Smartly

I investigated the existing 74 Tactical Asset Allocation strategies on Allocate Smartly. These are the best 5 overall strategies.

The best 5:

Faber’s Global Tactical Asset Allocation - Aggressive 3 and 6

The Faber Global Tactical Asset Allocation strategies meet all my “top 10%” criteria. The “Aggressive 3” version is more concentrated. It has a larger return but also greater losses than the “Aggressive 6” version.

Financial Mentor’s Optimum 3

This strategy has a very high 6%+ “forever” rate for withdrawal. It navigates different economies with a diverse set of investments, including cash. As a concentrated strategy (selects up to 3 investments at one time), it could pair well with a diversified strategy like the Meta Strategy (see below).

Financial Mentor’s All-Weather Quad Momentum

This very concentrated strategy selects the best two investments for a given month. It meets every “top 10%” selection criteria and has a very high 15.6% yearly return since 1970–this is throughout many economic climates! Be careful: it can also decline by more than 20%.

Meta Strategy

This strategy builds a diverse portfolio of the top 11 tactical systems on the Allocate Smartly platform. It does this each month. It’s a great diversifier. Meta also incorporates buy & hold within its portfolio when the opportunity arises.

These five strategies are all excellent. Yet, no strategy is perfect at all times. So it makes sense to diversify investment holdings among strategies. Fortunately, Allocate Smartly allows for this!

To create the Fast Follow Investor model that I use, I combined three of the strategies above. I find that three strategies best optimize for concentration (higher return) and diversification (lower volatility means a smaller loss). It’s the best mix of opportunity and risk reduction.

I also prefer strategies that are simple to put in place. Allocate Smartly offers flexible trading throughout the month and more than once a month. It is easy to get complicated quickly. I see two downsides to this:

- Complication leads to analytical minds over-optimizing investment portfolios. Optimizing looks backward at performance, which is not correct.

- Also, I prefer that managing my investments does NOT rule my life.

And so, I have chosen to build the Fast Follow Investor model to trade once at the end of each month. I can prepare and execute trades in 1-2 hours and then get back to living my life.

Risk is never vanquished. Though managed, it remains

There is no such thing as a completely risk-free investment. The Fast Follow Investor model is no exception. Fast Follow Investing, and all tactical strategies for that matter, are susceptible to:

- Whipsaws - Models calculate trades based on trends. When the trend is a whipsaw or wave, I buy investments on the way up only to watch them decline. Then, I sell them only to watch them go back up again. Buy-and-hold indexing stays neutral during whipsaws, whereas tactical strategies register losses. Buy and hold is a great diversifier.

- Steep, mid-month market drops - Mid-month drops take place before tactical strategies can adjust to move money out of the investment.

In both cases, know that these risks exist. But, I consider the risks are lower than accepting “market risk”. That said, I also choose to address them within and outside the model:

First, the Fast Follow Investor model will self-correct (internal). Also, I have part of my savings invested in buy & hold passive index funds as a close, but second-best investment strategy (external).

[Fast Follow Investor model: Email #5]

Creating the Fast Follow Investor model of models

The Fast Follow Investor model combines the best 3 Tactical Asset Allocation strategies available to individual investors (you and me). The model has shown strong historical performance. Plus, it is set up for future success.

Excellent historical performance

Historical performance is tricky. You must take it with a grain of salt. Always keep this in mind: assume that a strategy’s worst performance is still to come.

For example:

- The Fast Follow Investor model, so far, has recovered from negative returns within 16 months. But, I assume 3 years to be safe.

- The model’s “forever” rate for withdrawal is currently 6%, but I assume 5% for my retirement calculations.

We need to hope for the best, but plan for the worst. An old maxim says that “the market tricks us into taking the most money from the greatest number of investors.” -Not attributed

All that said, here are the statistics for the Fast Follow Investor model since December 1986, before the October 1987 crash.

The Fast Follow Investor model has greater returns with less risk than the 60 stock/40 bond benchmark. It rolls up to an all-important 6% “forever” rate for withdrawal. Wow. You can [retire much sooner](the link to the number is smaller than you think post) with a 6% “forever” rate!

Poised for strong future performance

Now, let’s look forward. I’ll assess the Fast Follow Investor model against two key characteristics of a “top 10%” Tactical Asset Allocation strategy:

#1 The strategy works in many different economies because it can access different investments.

Let’s review the Fast Follow Investor model’s performance in the “Lost Decade” of the 2000s. Access to non-stock investments produced amazing returns compared to the 60/40 benchmark.

[Logrithmic scale]

[Logrithmic scale]

From Aug 2000 to Feb 2009, the 60/40 benchmark returned -5.8%. Think about that. After 9 years, an investor had less money than when he/she started.

I remember this time in history. My wife placed a large chunk of her savings in a Vanguard S&P 500 Index fund right before the dot com crash. It took F-O-R-E-V-E-R for it to recover. If we had been nearing retirement at the time, this would have N-E-V-E-R worked for us!

Meanwhile, the Fast Follow Investor portfolio returned 232% in those 9 years.

#2 The strategy protects against severe losses by diverting investments to cash.

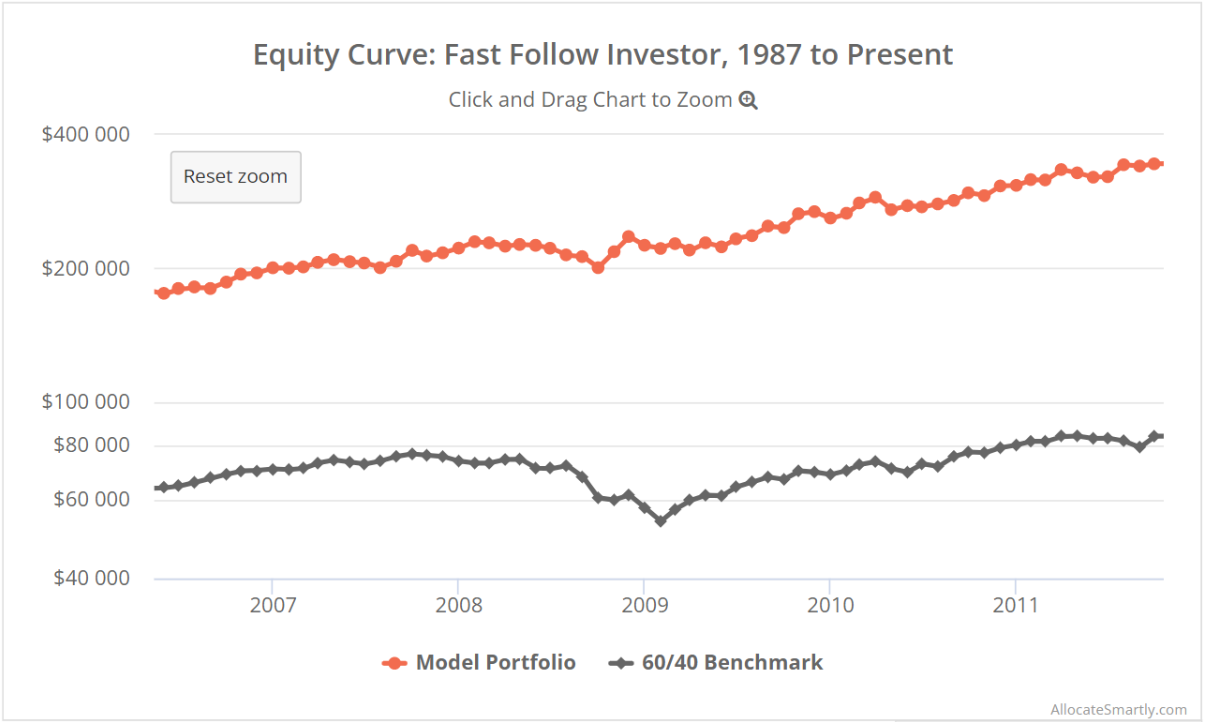

Let’s study how the Fast Follow Investor model protects against steep losses. We’ll investigate its performance during the Great Recession of 2008 and 2009.

From the market top in October 2007, the 60/40 benchmark declined by 29.5% to its bottom. In comparison, the Fast Follow Investor model bottomed at a negative 12.3%.

[Logrithmic scale]

[Logrithmic scale]

You can see the difference in the graphic. Click here to learn more about the math behind investment loss asymmetry. Recovery from a shallow loss happens so much faster.

[Go Forth!: Email #6]

Practical considerations of investing this way

I’m amazed at the simple elegance with which Fast Follow Investing improves returns and lowers risk. It’s my duty to share what I’m doing for everyone’s benefit.

But, when you choose to apply it -or a variation of it- in the real world, there are a few practical considerations an investor must consider. I present them in increasing order.

#1 Taxes This is a minor consideration. Don’t worry about it.

Taxes are real and buying and selling each month locks in capital gains and losses. When using Fast Follow Investing in a taxable account, the model will have a higher tax burden than traditional buy & hold investing. It’s okay for two reasons:

- I don’t let the tail wag the dog. Meaning, tax treatment shouldn’t detract from a superior investment strategy. For example, let’s say taxes reduce returns by 1%. I’d rather net an 11% return (12% less 1%) with Fast Follow Investing than an 8% return (8% less 0%) that is tax efficient.

- The underlying mechanics of the model mean that I sell losers quickly and hold on to winners. This results in more short-term capital losses, and also more long-term capital gains. This is the best way to handle capital gains if you must accept them!

#2 Access to ETFs This requires medium consideration. There are options.

It’s obvious, but if an investor does not have access to the necessary ETFs, you cannot replicate the Fast Follow Investor model. Consider two common scenarios:

- “I have access to similar ETFs, but not the exact ETFs that Fast Follow Investing calls for.” Solution: In this case, it is okay to replace them. For example, to trade US Real Estate without the recommended “VNQ” ETF from Vanguard, I could use “IYR” from iShares or “PSR” from Invesco. The key is to always use the largest, most liquid ETF as a replacement. Email me at brian@fastfollowinvestor.com for suitable ETF alternatives.

- “I am implementing Fast Follow Investing in my 401(k) which has limited investment options. For example, it doesn’t have a fund that trades Gold or Commodities. (These are the most common.)”

Solution: In this case, there are two solutions.

- Get rid of my 401(k) and move investments to an IRA. I may not even need to change jobs. I have known employees with 401(k) plans that allow investment transfers out of the plans while still employed. When self-employed (in a micro-business), more options exist.

- I can stick with buy-and-hold passive index investing in my 401(k) and use Fast Follow Investing in an IRA or taxable account. Another example of this is my son’s 529 plan. 529 plans force buy & hold investing since most allow only two changes to the account each year. It is what it is. Though, I no longer add to his 529 plan. As of 2021, I’m opting to grow his college fund in a taxable account where I can use Fast Follow Investing!

#3 Human behavior This major consideration requires persistent attention.

Tragically, human emotion can ruin investment growth. An investor might deviate from the model because he/she “can do better” or “knows more” than the mathematically-proven strategy.

Economists say humans are rational and emotionless investors. Wrong! Humans are highly emotional, and it hurts our portfolios. But, we can train ourselves to become more level-headed investors by:

- Developing an edge in picking the right investment strategy and knowing it better than anyone else.

- Controlling the amount of money invested (bet size) so the particular investment strategy will never wipe us out.

- Turning positive behaviors into habits. Then, decisions aligned with our preferred strategy become automatic.

Most of all, we need social support. Investing is quite isolating. That is why joining a club or community of like-minded rational types is very important. We need each other to help us when times get tough. And they will get tough.

I write a lot on this topic. It is so important! Here is my argument for never losing sight of human emotion and its impact.

Recommending some next steps for you!

Congratulations, you’ve completed this series of lessons! But, please keep at it. Here’s how to keep learning…

You have a foundational understanding of Tactical Asset Allocation investing. You know my five favorite strategies. You understand what I expect to earn by Fast Follow Investing and have a handle on challenges often seen when investing this way.

Now it’s time to put the model to use. I urge you to take it slow. Try doing so, in this way:

- Calculate Fast Follow Investor trades for 2 months, but don’t make them. Watch how they would have performed.

- Next, do make the trades for the following 2-4 months. But, use only $10,000 (or up to 5% of your savings). You will continue to learn.

- Then, over the next 2-6 months, roll out Fast Follow Investing to the level you desire. It could be 25% of your investment portfolio as recommended in the Idols Framework. It could be more. It could be less. It’s up to you. During this time, invite a partner (spouse, friend) to join you on the journey.

This is how I did it back in 2021!

Within 6-12 months, you’ll be fully invested and sleeping very well at night. You’re accelerating your path to financial freedom.

In closing, remember, remember, remember: the math is sound. Our success depends on sticking with it. Our human biases make investing so hard. To help, keep reading my posts and use date night to make this a habit!

Happy investing…